BTC Price Prediction: Analyzing the Path to New Highs Amid Technical Consolidation and Bullish Catalysts

#BTC

- Technical Consolidation: BTC is trading below its 20-day moving average but shows bullish MACD momentum and is approaching Bollinger Band support levels

- Fundamental Catalysts: Potential dovish Fed policy changes and institutional adoption are creating positive market sentiment

- Price Targets: Industry experts project potential moves toward $200,000 based on current market dynamics and historical patterns

BTC Price Prediction

BTC Technical Analysis: Consolidation Phase with Bullish Potential

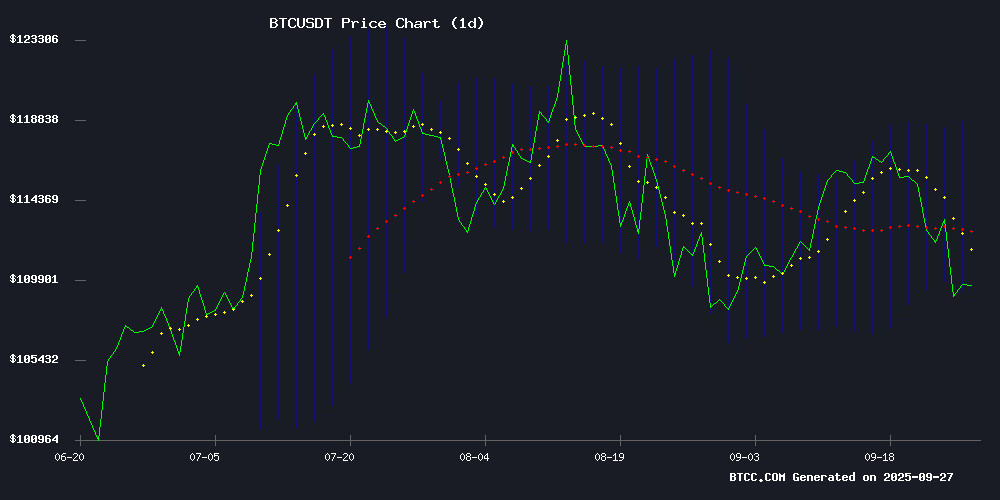

BTC currently trades at $109,303.74, below its 20-day moving average of $113,918.93, suggesting short-term consolidation. The MACD indicator shows positive momentum with a reading of 229.24, while Bollinger Bands indicate BTC is trading NEAR the lower band at $108,905.06, potentially signaling an oversold condition.

According to BTCC financial analyst James, 'The technical setup suggests BTC is in a consolidation phase. Trading near the lower Bollinger Band often precedes upward movements, while the positive MACD indicates underlying bullish momentum. A break above the 20-day MA could trigger a MOVE toward the upper band at $118,932.'

Market Sentiment: Bullish Catalysts on the Horizon

Positive sentiment dominates the crypto space with Galaxy Digital CEO predicting a Bitcoin rally to $200,000 based on potential dovish Fed policy changes. Institutional interest continues to grow as JPMorgan and Citigroup upgrade mining companies, while OranjeBTC's $385 million Bitcoin purchase signals strong institutional confidence.

BTCC financial analyst James notes, 'The combination of potential Fed policy shifts and increasing institutional adoption creates a favorable environment for Bitcoin. The 'Uptober' seasonal pattern and Wall Street's growing interest in cloud mining further support positive price action in the coming months.'

Factors Influencing BTC's Price

Galaxy Digital CEO Foresees Bitcoin Rally to $200K on Potential Dovish Fed Chair Appointment

Mike Novogratz, CEO of Galaxy Digital, positions the upcoming Federal Reserve leadership transition as a pivotal moment for cryptocurrency markets. His $200,000 Bitcoin price projection hinges on President Trump selecting a monetary policy dove to replace Jerome Powell. The prediction comes as BTC hovers near $109,000 following a turbulent week that saw $1.1 billion in crypto liquidations.

Three candidates—Kevin Hassett, Chris Waller, and Kevin Warsh—remain in contention for the Fed chairmanship. Novogratz contends that dovish policy continuity would create ideal conditions for risk assets, with Bitcoin positioned as the prime beneficiary. "Can Bitcoin get to $200K? Of course it could," the executive stated during a recent interview, emphasizing the crypto market's sensitivity to macroeconomic policy shifts.

Bitcoin Price Prediction: Novogratz Sees $200K if Trump’s Fed Pick Turns Dovish

Galaxy Digital CEO Mike Novogratz predicts a potential surge in Bitcoin's price to $200,000, contingent on the next U.S. Federal Reserve chair adopting a dovish monetary policy. Such a scenario, he argues, could serve as a significant catalyst for the crypto market, alongside gold, creating what he describes as a "blow-off top."

Novogratz emphasizes that aggressive rate cuts by a Trump-appointed Fed chair might trigger an unexpected market reaction, propelling Bitcoin to new highs. However, he cautions that such a development could have adverse effects on the U.S. economy, despite its bullish implications for digital assets.

The crypto market remains vigilant as Jerome Powell's term as Fed chair nears its end, with investors speculating on the potential impact of his successor's policies on financial markets and the broader crypto industry.

Bitcoin’s Bold Move Sparks A Crucial Market Debate

Bitcoin's recent 12.75% decline from its historic peak of $124,500 has ignited a fierce debate among market participants. The cryptocurrency now teeters between two narratives: a healthy correction in an ongoing bull market or the early tremors of a new bear cycle.

Technical analysts observe eerie parallels with 2021's market structure, when Bitcoin's parabolic rise culminated in a 50% collapse. The breakdown of an ascending wedge pattern suggests potential downside targets between $60,000-$62,000, with some traders eyeing $50,000 as critical support. Yet countering this bearish thesis, Jesse and other analysts highlight the 200-day moving average's historical significance as a bull market foundation, projecting a potential bottom formation between $104,000-$106,000.

The macroeconomic backdrop adds complexity. Bitbull's analysis suggests the U.S. economic cycle hasn't yet reached its zenith, leaving room for extended crypto market upside. This fundamental divergence creates a battleground where technical patterns and macroeconomic forces collide.

JPMorgan and Citigroup Upgrade Riot Platforms on AI Computing Pivot

Riot Platforms, a Bitcoin mining firm, received significant upgrades from JPMorgan and Citigroup as it shifts focus toward artificial intelligence and high-performance computing. JPMorgan raised its rating to Overweight with a $19 price target, while Citigroup upgraded to Buy with a $24 target.

The upgrades reflect confidence in Riot's strategic pivot, leveraging its 700 MW Rockdale facility and upcoming 1 GW Corsicana site. Analysts highlight potential colocation agreements worth $3.7-8.6 million per MW, positioning Riot as a scaled player in both Bitcoin mining and AI infrastructure.

Despite broader sector declines, Riot's shares showed relative resilience, dropping just 1.2% to $16.55. The firm's cheap power contracts and hashrate expansion potential distinguish it from peers facing profitability pressures.

Exclusive Interview: The Crypto Factor Behind Modern Ransomware

Bitcoin has become the linchpin of the global ransomware industry, with nearly 98% of tracked ransomware payments made in cryptocurrency last year, according to Chainalysis. The pseudonymous, borderless nature of crypto has enabled attackers to operate at unprecedented scale, demanding payments across jurisdictions without revealing identities.

Cybercriminals now automate decryption keys upon receipt of Bitcoin payments, slashing cash-conversion cycles. Sophisticated chain-hopping techniques—moving funds from BTC to stablecoins across multiple blockchains—have further complicated money tracing efforts by investigators.

"Cryptocurrency provides ransomware crews with the perfect trifecta: global reach, speed, and anonymity," noted a cybersecurity expert in an exclusive Coinpedia interview. The 2025 crypto theft surge, including the largest single breach in history, underscores how digital assets have become the lifeblood of cybercrime.

Top Bitcoin Cloud Mining Platforms Dominate in 2025 as AIXA Miner Leads with Maximum ROI

Bitcoin maintains its dominance as the premier digital asset in 2025, yet traditional mining faces escalating challenges due to soaring electricity costs and specialized hardware requirements. Cloud mining has emerged as the preferred alternative, offering investors seamless access to Bitcoin yields without operational complexities.

AIXA Miner tops the 2025 rankings with AI-driven efficiency, transparent contracts, and eco-conscious operations. Its $20 bonus for new users eliminates entry barriers, delivering immediate risk-free returns. The platform exemplifies the industry's shift toward turnkey solutions that prioritize profitability and sustainability.

GameStop’s Volatile Stock Masks Eroding Retail Core Amid Bitcoin Pivot Speculation

GameStop's stock remains a playground for meme-fueled volatility, swinging between euphoria and punishment with no clear direction. Beneath the social media frenzy, the company's core retail business continues to deteriorate. Last quarter's net sales of $972.2 million revealed troubling trends—higher-margin software sales plunged 27%, dragging gross margins down to 29.1%.

Management's silence speaks volumes. With no earnings call and an opaque strategy, investors are left guessing about GameStop's future. The sale of Canadian operations and potential retreat from France suggest contraction, not revival. A Bitcoin pivot could have been transformative for the cash-rich company, but execution remains uncertain and unconvincing.

The market's split personality reflects this duality—traders chase the ghost of 2021's meme rally while fundamentals whisper caution. For now, GameStop exists in two worlds: one of viral potential, the other of fading relevance.

OranjeBTC Appoints Fernando Ulrich to Board Amid $385M Bitcoin Purchase

OranjeBTC, poised to become Latin America's largest publicly traded Bitcoin treasury firm, has named economist and early Bitcoin advocate Fernando Ulrich to its Board of Directors. The strategic hire follows the company's record $385 million BTC acquisition, bringing its total holdings above $400 million ahead of an October listing on Brazil's B3 exchange.

Ulrich brings rare credibility as author of Brazil's first Portuguese-language Bitcoin book in 2014 and host of a top economics YouTube channel. His appointment signals OranjeBTC's commitment to a Bitcoin-only strategy as institutional adoption accelerates across emerging markets.

The company will go public via reverse merger with Intergraus, targeting an 85% free float. Ulrich's policy expertise may prove critical as regulators scrutinize corporate crypto holdings. This move establishes OranjeBTC as a bellwether for Bitcoin adoption in Latin American capital markets.

Uptober Sparks Anticipation in the Crypto World

Historically bearish September gives way to October's bullish promise in cryptocurrency markets. Dubbed "Uptober" by traders, this month has frequently marked the beginning of significant rallies, with 2017 and 2021 serving as notable examples. Market participants anticipate potential ETF approvals and central bank developments to fuel momentum.

Bitcoin (BTC), currently trading at $109,500, shows signs of stabilization after recent volatility. Analyst Carl Moon projects a possible retracement to $104,000 before a push toward new all-time highs near $150,000. The altcoin market mirrors this steadiness, recovering from double-digit declines earlier in the year.

Political cycles appear to influence market behavior, with some traders noting stronger Q4 performance during U.S. election years. While historical patterns don't guarantee future results, the crypto community watches October with particular interest—a month where rhymes of past bull runs often echo through price charts.

Wall Street Investors Turn to Cloud Mining Amid Bitcoin Volatility

Bitcoin's price turbulence has sparked a strategic pivot among institutional investors. While BTC faces downward pressure, seasoned Wall Street players are reportedly generating $8,600 daily through OurCryptoMiner's cloud mining platform—a UK-based service operating since 2019 that combines AI optimization with clean energy solutions.

The shift reflects growing disillusionment with passive holding strategies during market contractions. 'Convert BTC into sustained cash income' emerges as the new mantra, with mining positioned as a hedge against volatility. OurCryptoMiner's regulatory compliance and security protocols appear central to its appeal among risk-averse capital allocators.

Top 7 Mobile Crypto Mining Apps in 2025: Legitimacy and Risks

The allure of mining cryptocurrency via smartphone has spawned a wave of apps promising effortless Bitcoin and altcoin earnings. Yet the landscape is fraught with deception. While some apps facilitate modest gains or link to legitimate cloud mining operations, others are thinly veiled scams or ad traps.

For meaningful returns, experts recommend pairing mobile apps with established cloud mining providers. ETNCrypto emerges as the industry benchmark, offering transparent contracts backed by industrial ASIC rigs—a stark contrast to competitors plagued by opacity. The Australia-registered platform provides real-time earnings tracking and scalable options, catering to both novices and professionals.

The market's fragmentation underscores a critical divide: verifiable operations like ETNCrypto versus speculative mobile solutions that often prioritize user acquisition over sustainable mining economics.

How High Will BTC Price Go?

Based on current technical indicators and market sentiment, BTC shows potential for significant upward movement. The current price of $109,303.74 represents a consolidation phase below the 20-day moving average, but multiple factors suggest bullish momentum ahead.

| Indicator | Current Value | Implication |

|---|---|---|

| Current Price | $109,303.74 | Consolidation below MA |

| 20-Day MA | $113,918.93 | Resistance level |

| MACD | 229.24 (Positive) | Bullish momentum |

| Bollinger Lower Band | $108,905.06 | Support level |

| Price Target | $200,000 | Analyst prediction |

BTCC financial analyst James suggests that 'A combination of technical factors and fundamental catalysts could propel BTC toward the $200,000 level mentioned by industry leaders. The key resistance at the 20-day MA needs to be broken for sustained upward movement.'